Critical illnesses can change life overnight not just medically, but financially as well. With rising healthcare costs and longer recovery periods, many families struggle to manage income loss and ongoing expenses even after hospital bills are paid.

This is why critical illness insurance in India is increasingly being considered an essential part of financial planning.

While regular health insurance focuses on hospitalization costs, critical illness insurance provides broader financial support when life-threatening diseases disrupt normal income and lifestyle.

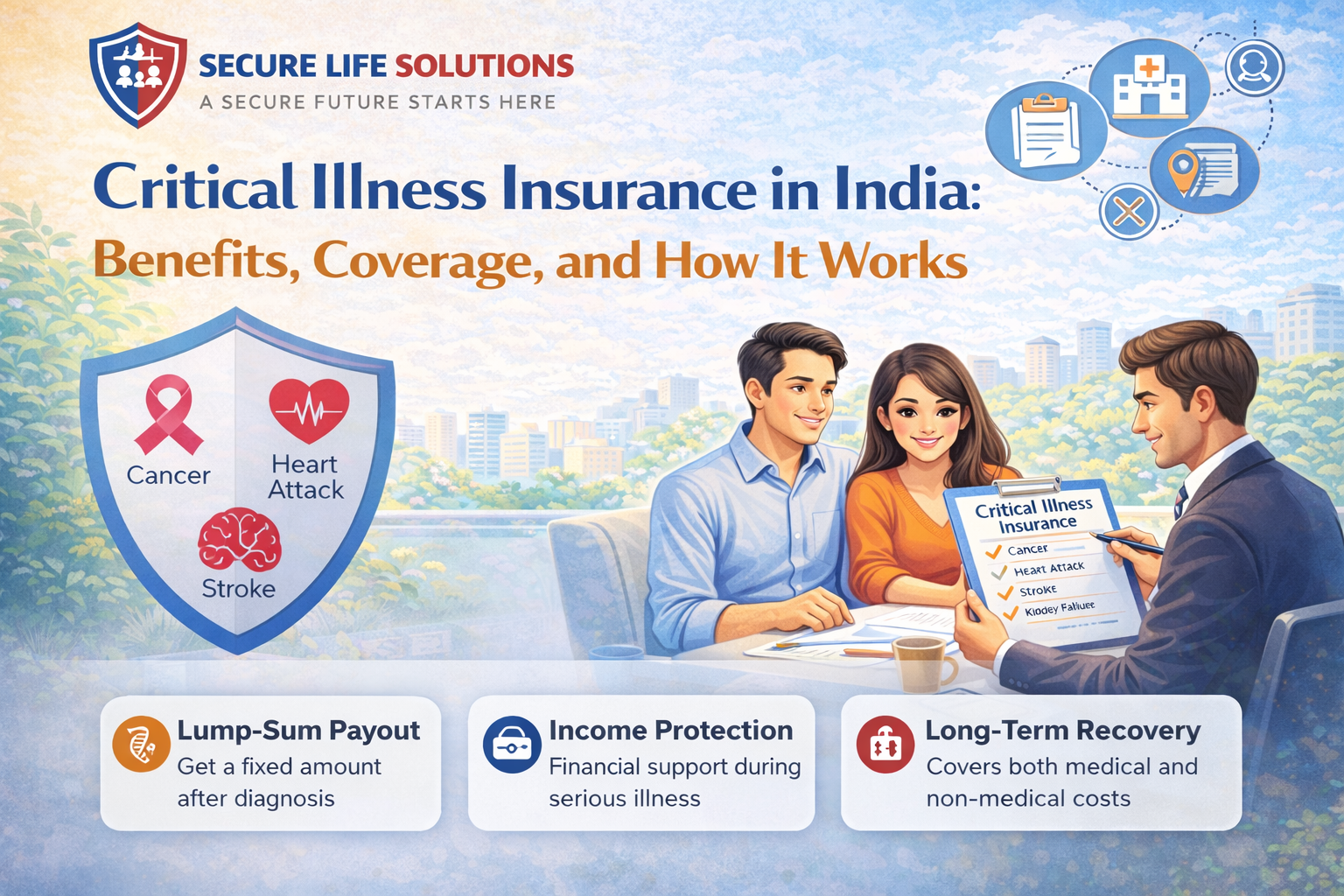

Understanding critical illness insurance benefits helps individuals see why this policy is different from standard medical cover. The biggest advantage is the lump-sum payout, which is paid immediately after diagnosis of a covered illness.

Key benefits include:

Financial support during income loss

Coverage for non-medical expenses

Flexibility in how the payout is used

Reduced dependence on savings or loans

According to healthcare cost studies published by the World Health Organization, indirect expenses and income loss form a significant part of the financial burden during critical health insurance alone..

“Critical illness insurance is not about paying hospital bills it’s about protecting your income, savings, and financial stability when recovery takes time.”

One of the most searched comparisons is critical illness insurance vs health insurance. Although both are related to healthcare, their purpose is very different.

Covers hospitalization and treatment costs

Pays hospitals directly (cashless or reimbursement)

Limited to medical expenses

Pays a lump-sum amount after diagnosis

Covers both medical and non-medical costs

Helps manage income loss and lifestyle changes

Financial experts often recommend combining critical illness insurance with health insurance for complete protection, a strategy also explained by Investopedia in its insurance education resources.

Many buyers ask, how does critical illness insurance work, especially compared to traditional medical policies. The process is simple:

The policyholder purchases coverage and pays regular premiums

A covered critical illness is diagnosed

Medical documents are submitted for verification

The insurer pays a fixed lump-sum benefit

Most policies include a waiting period and a survival period. Once the claim is paid, the policy usually ends. Clear explanations of claim structures are also discussed in insurance planning guides.

Critical illness insurance coverage typically includes a predefined list of serious illnesses. While coverage varies by policy, commonly covered conditions include:

Cancer (major stages)

Heart attack

Stroke

Kidney failure

Coronary artery bypass surgery

Major organ transplant

Paralysis

Multiple sclerosis

It is important to carefully review definitions, severity clauses, and exclusions mentioned in the terms and conditions, as coverage eligibility depends on precise medical definitions.

Understanding the critical illness insurance claim process helps reduce confusion during stressful situations. The process generally involves:

Diagnosis confirmation from a qualified medical professional

Submission of medical reports and claim forms

Verification by the insurer

Lump-sum payout after approval

Regulatory guidance on fair claim settlement practices is provided by the Insurance Regulatory and Development Authority of India (IRDAI).

The critical illness insurance waiting period refers to the initial period after policy purchase during which claims are not accepted. This period usually ranges from 30 to 90 days, depending on the policy.

Additionally, many policies include a survival period, meaning the insured must survive for a specified number of days after diagnosis to receive the benefit. These conditions help insurers manage risk and prevent misuse.

A common question among buyers is, is critical illness insurance worth buying? The answer depends on financial responsibilities, income dependency, and lifestyle risks.

Critical illness insurance is especially valuable for:

Salaried professionals dependent on monthly income

Self-employed individuals without fixed income

Primary earners with family responsibilities

Individuals with a family history of serious illnesses

For many families, the lump-sum payout provides crucial financial breathing space during recovery, making it a worthwhile addition to long-term financial planning.

The biggest differentiator is the lump sum payout critical illness insurance provides. Unlike health insurance, the payout is not linked to bills or receipts.

This lump sum can be used for:

Daily household expenses

EMI payments

Travel and accommodation during treatment

Rehabilitation and lifestyle changes

Financial literacy platforms often emphasize lump-sum insurance as a key tool for income protection during medical crises.

Understanding the difference between health insurance and critical illness insurance helps avoid underinsurance. Health insurance focuses on hospital expenses, while critical illness insurance protects income and savings during long-term illness.

Using both together ensures:

Hospital bills are covered

Income loss is managed

Long-term savings remain intact

Many individuals review critical illness cover alongside term life insurance plans to strengthen overall family protection.

In 2022, a 38-year-old marketing professional from Mumbai was diagnosed with early-stage cancer. His health insurance covered hospitalization and chemotherapy, but he had to stop working for six months.

Household expenses, EMIs, and treatment-related travel costs quickly added up. Fortunately, his critical illness insurance paid a lump sum upon diagnosis. This helped him manage income loss without liquidating investments or borrowing money.

Such real-world scenarios are frequently discussed in insurance education blogs, highlighting the importance of lump-sum protection.

Before purchasing, individuals should evaluate:

List of covered illnesses

Waiting and survival periods

Policy exclusions

Sum insured adequacy

Premium affordability

Understanding these factors ensures informed decision-making and reduces claim-related disputes later.

Critical illness insurance works best when combined with:

Health insurance for medical expenses

Life insurance for family income protection

General insurance for asset protection

A diversified insurance portfolio ensures financial stability across multiple life risks.

Critical illness insurance in India is no longer optional; it is a practical financial safeguard in today’s high-cost healthcare environment.

While health insurance manages hospital bills, critical illness insurance protects income, savings, and lifestyle during prolonged treatment and recovery.

By understanding critical illness insurance benefits, coverage, claim process, and how it differs from health insurance, individuals can make confident, well-informed financial decisions.

Critical illness insurance is a policy that provides a lump-sum payout when the insured is diagnosed with a serious illness listed in the policy, such as cancer, heart attack, or stroke.

2. How is critical illness insurance different from health insurance?

Health insurance covers hospitalization and treatment costs, while critical illness insurance pays a fixed lump sum after diagnosis.

3. Which illnesses are covered under critical illness insurance?

Most policies cover illnesses such as cancer, heart attack, stroke, kidney failure, major organ transplant, paralysis, and coronary artery bypass surgery.

4. Who should consider buying critical illness insurance?

Critical illness insurance is ideal for salaried professionals, self-employed individuals, primary earners, and people with a family history of serious illnesses.

5. When is the best time to buy critical illness insurance?

The best time to buy critical illness insurance is at a younger age when you are healthy.